sales tax rate in tulsa ok

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. 74101 74102 74103.

Oklahoma Sales Tax Information Sales Tax Rates And Deadlines

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

. Sales and Use Tax Rate Locator - University of Oklahoma. Our address database is available for retailersvendors who may want to incorporate this information into their own systems. As for zip codes there are.

The Tulsa County Sales Tax is 0367 A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. 31 rows The state sales tax rate in Oklahoma is 4500.

The Oklahoma state sales tax rate is currently. The base state sales tax rate in Oklahoma is 45. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365.

The Oklahoma sales tax rate is currently. State of Oklahoma - 45 Tulsa County - 0367 City - 365 The City has five major tax categories and collectively they provide 52 of the projected revenue. Interactive Tax Map Unlimited Use.

They do not have. What is the sales tax rate in Tulsa Oklahoma. Oklahoma City 8625 Tulsa 8517 Edmond 825 Norman 875 Lawton 9 Stillwater 8813 Broken Arrow 8417 Enid 91 Oklahoma Sales Use Tax Information The Oklahoma OK.

You can find more tax. The base state sales tax rate in Oklahoma is 45. 828 Average Sales Tax For Tulsa County Oklahoma Summary Tulsa County is located in Oklahoma and contains around 11 cities towns and other locations.

The Tulsa sales tax rate is. 0188 ADAIR CTY 175 0288 ALFA CTY ALF 2. The Tulsa County sales tax rate is.

With local taxes the total sales tax rate is between 4500 and 11500. Effective May 1 1990 the State of Oklahoma Tax Rate is 45. The tax must be paid on the occupancy or the right of occupancy of room s in a hotel.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. Total Sales Tax by City. Find your Oklahoma combined.

Tulsa is in the following zip codes. The current total local sales tax rate in Tulsa OK is 8517. 2483 lower than the maximum sales tax in OK The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

Ad Lookup Sales Tax Rates For Free. The purpose of the Sales Tax Overview Committee to review and report upon the expenditures of third-penny capital improvements sales tax revenues as set forth by City ordinances and the. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115.

The sales tax rate in the Tulsa city limits will remain the same 365 percent 8517 percent overall because the last temporary sales tax will expire. City rates range from 1 to 5 percent. Oklahomans are paying anywhere from 5 cents to 11 cents on the dollar in sales or use taxes depending on the city and county they live in.

Sales Tax Breakdown Tulsa Details Tulsa OK is in Tulsa County. Search for Tax SalesUse rate s. The 2018 United States Supreme Court decision in South Dakota v.

7288 TULSA CTY 0367 7388 AGONER CTY W 130 7488 ASHINGTON CTY W 1. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037.

Cities and towns may levy sales taxes in any amounts as long as voters approve. Some cities and local. This is the total of state county and city sales tax rates.

The current total local sales tax rate. The lowest possible total sales tax is 45 percent while the highest. You can find more tax rates and.

The County sales tax rate is. The December 2020 total local sales tax rate was also 8517. Oklahoma has recent rate changes Thu Jul 01.

What S The Car Sales Tax In Each State Find The Best Car Price

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Aqua Lily Pad Lake Fun Floating In Water

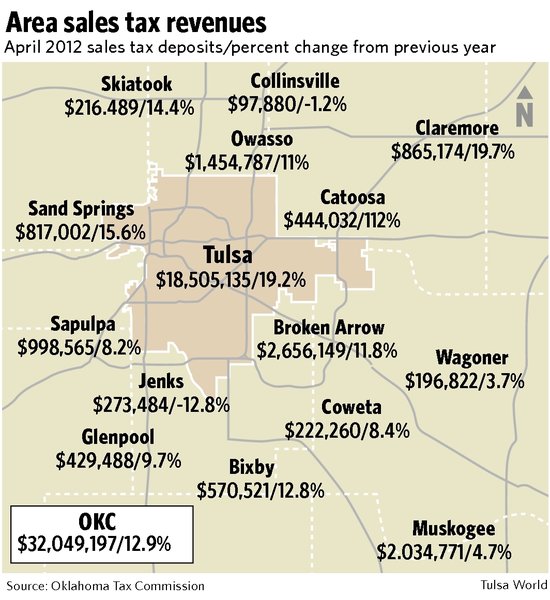

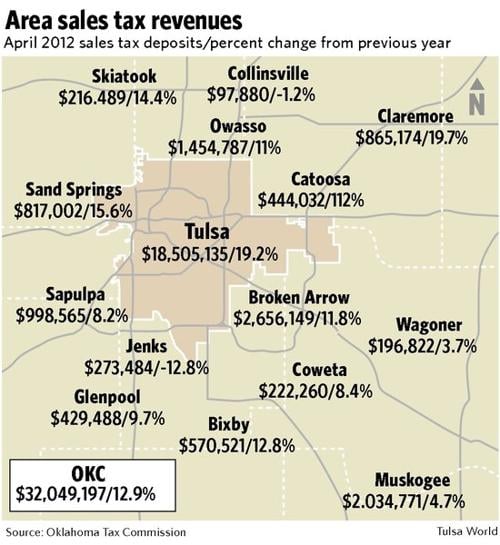

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Oklahoma Sales Tax Small Business Guide Truic

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Total Sales Tax Per Dollar By City Oklahoma Watch

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Truck Accessories Enclosed Trailers

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

Oklahoma State Tax Ok Income Tax Calculator Community Tax

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

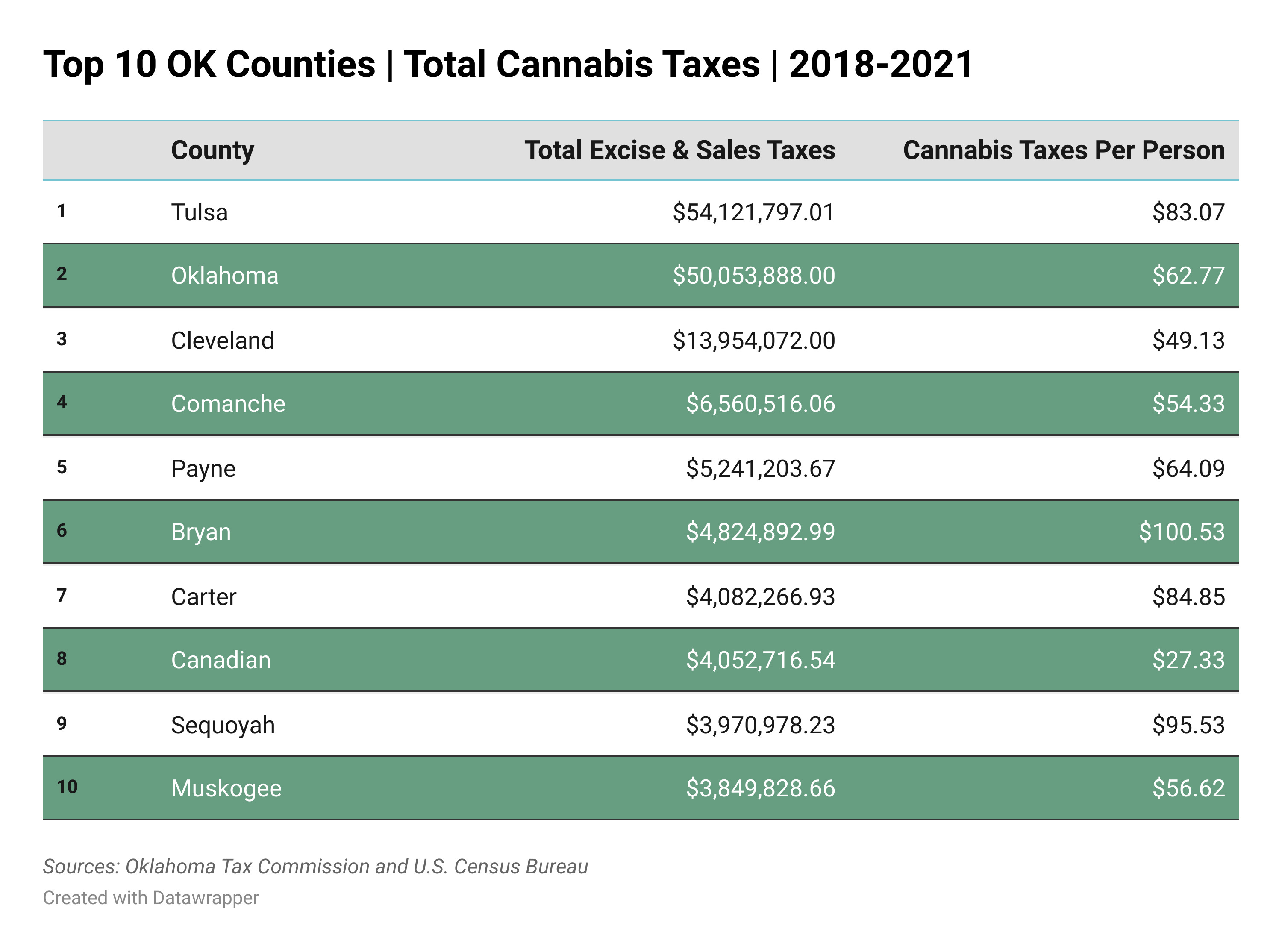

Districts Of Ok Lawmakers Targeting Cannabis Generated 27 5m In New Weed Taxes

How Oklahoma Taxes Compare Oklahoma Policy Institute

Hitch It Tulsa Ok Trailers For Sale Enclosed Cargo Trailers Fifth Wheel Trailers