vermont income tax refund

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. And you are not enclosing a payment then use this address.

Where S My Refund How To Track Your Tax Refund 2022 Money

Property Tax Bill Overview.

. A tax refund may be. A tax credit may be applied toward the tax due at the time of registration for a vehicle registered to you and sold three 3 months prior to the purchase. Find out when your Vermont Income Tax Refund will arrive.

Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status of your return and refund. Click on Check the Status of Your Return Personal Income Tax Return Status. Extensions - A 6-month extension is available to extend the filing of a Vermont income tax return by filing Form IN-151 - Application for Extension of Time to File Form IN-111.

For questions about your health insurance or. COVID-19 Crisis and Your Taxes. How to Protect Your Income and Property.

To check the status of. Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter. You can also contact Vermont Health Connect by phone at 1-855-899-9600 or online.

Rates range from 335. If you live in Vermont. Details on how to only.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. Vermont State Income Tax Return forms for Tax Year 2021 Jan.

Vermont State Income Tax Forms for Tax Year 2021 Jan. Bankruptcy in Vermont FAQs. An extension of time.

Open enrollment for 2023 plans begins November 1 2022. Pay Estimated Income Tax by Voucher. Commissioner Craig Bolio Deputy Commissioner Rebecca Sameroff.

Then click Search to find your refund. Form CO-411 Corporate Income Tax Return is due on the date prescribed for filing under the Internal Revenue Code. Vermont Income Taxes.

The refund date youll see doesnt include the days your financial institution may take to process a direct deposit or the time a paper check may take to arrive in the mail. And you are filing a Form. And you are enclosing a payment then use this address.

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. Wheres my Vermont tax refund. Vermont State Tax Refund Status Information.

The 2022 state personal income tax brackets. Pay Estimated Income Tax Online. Please wait at least three days before checking the status of your return on electronically filed returns and six.

Irs Owes Taxpayers More Than 1 Billion In Unclaimed Tax Refunds Tax Refund Income Tax Return Irs

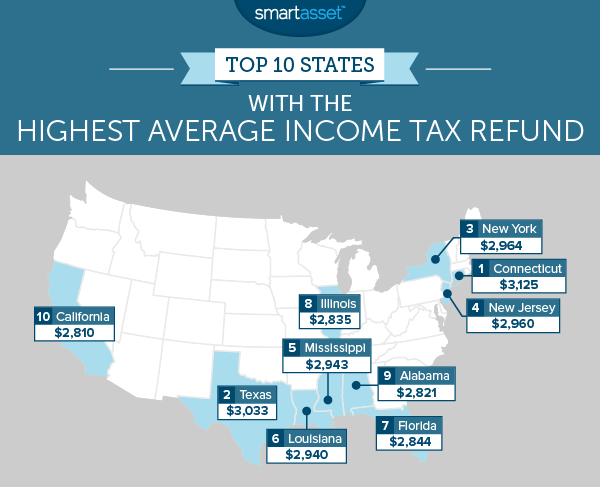

Here S The Average Irs Tax Refund Amount By State

Where Is My Refund Easy Tax Store

The Average Tax Refund In Every State Smartasset

Why Tax Refunds Are Taking Longer Than Usual

Irs Sends Out 1 5 Million Surprise Tax Refunds

Income Tax Refunds Of Over Rs 1 83 Lakh Cr Issued So Far This Fiscal The Financial Express

Jansport Virginia Tech Shirt Tech Shirt Jansport Shirts

The Average Tax Refund In Every State Smartasset

Tax Deadline Extension What Is And Isn T Extended Smartasset

Here S The Average Irs Tax Refund Amount By State Gobankingrates

Vermont State Tax Refund Vt Tax Brackets Taxact Blog

Jordan Weissmann On Twitter Cbo Just Released Its New 15 Min Wage Analysis Adds 58b To The Deficit Kills 1 4m Jobs Have T Budgeting No Response Senate

What Is Difference Between Tax Return And Tax Refund Tax Refund Tax App Tax Return

Claim Tax Refunds As Income On Tax Return

Where S My Refund Vermont H R Block

The Average Tax Refund Is 300 Higher This Year Money

50 000 More Vermont Returns Expected By Wednesday Tax Deadline Vtdigger

/cloudfront-us-east-1.images.arcpublishing.com/gray/TWLAHS3UMZCJ7BZ553JPXH4WAA.png)